Persistent inflation - and an interest rate increase - brings about a volatile April 2024, with equities moving in both directions on a daily basis

There has been a significant shift in market expectations in 2024 to date – while we started the year with optimism around the disinflation progress allowing significant rate cuts during the year, the odds of a June Fed rate cut dropped to 20% from the prior weeks 60% probability, and following this shift we saw interest rates increase.

Introduction

April was a volatile month for equities with big moves in both directions. This was largely driven by a third month of higher than expected inflation which shifted the narrative to higher for longer rates expectations. March core CPI (ex-food and energy) rose 0.4% month on month which was hotter than the estimated 0.3%. To add to the alarm was the three month annualised pace of 4.53% which was the highest since May 2023. Following the CPI reading the odds of a June Fed rate cut dropped to 20% from the prior weeks 60% probability. Following this shift we saw interest rates increase which put some pressure on the bond market.

Economic data was not the only driving factor in April with markets seeing a flight to safety as geopolitical tensions ramped up in the Middle East. Both Israeli and Iran launched direct attacks on each other which increased fears of a wider war and some commentators going to the extreme of a potential third world war. Naturally this drove a risk off sentiment in markets however, this reversed fairly quickly as the narrative from both Iran and Israel was focused on avoiding any further escalation. Although tensions remain elevated the immediate concerns of escalation have abated.

On top of all the macro news flow, April also was the start of earnings season with the banks kicking off proceedings. Generally results were good although guidance was a bit disappointing as the markets expectations of higher Net Interest Income did not materialise. To date the big moving technology players have been a bit mixed with Meta disappointing due to expectations of higher capex and operating costs as the roll out of AI is proving more expensive. On the other hand both Google and Microsoft had very strong results which helped buoy the market and validated the AI tailwind.

Locally the IMF further downgraded South Africa’s GDP growth forecast for 2024 to 0.9% which sits lower than the Reserve Banks expectations of 1.2% growth. Neither figure is high enough for the country to see positive change. Part of the negative downgrade was due to the constraints seen in the ports and rail network. On a positive front load shedding has eased significantly and the current expectations for winter are ‘only’ stage 2. This is a significant improvement from a year ago and will greatly assist the economy as a whole. There was a lot of activity in the mining sector with a number of the PGM miners sadly cutting jobs while BHP made a surprise bid for Anglo although a condition of the bid was excluding the South African assets. To date Anglo has rejected the bid so the market is waiting to see BHP’s response. As we move into May we are weeks away from the South African election which will have a significant impact on policy going forward and in turn the investment landscape.

Macro Environment

To date 2024 has seen a significant shift in market expectations. We started the year with optimism around the disinflation progress which would allow for significant rate cuts during the course of 2024. After 3 months of higher than expected inflation these expectations have dwindled and the market is now expecting between 1 and 2 cuts while some commentators believe there won’t be any cuts in 2024. This has dampened the soft landing narrative where the fed successfully brings down inflation towards their target without pushing the economy into a recession. As outlined by the Statista chart on the next page the market has shifted expectations towards a no landing scenario which is where the economy continues to grow and inflation remains elevated. Fortunately the hard landing scenario has largely been ruled out as economic growth remains strong however globally rate cut expectations are being pushed out as sticky inflation persists.

During the course of last year we spoke about the last bit of inflation returning to target being the hard part which is what central banks are facing now. The good news is that there is still a path to inflation returning to target it is just likely to take longer than initially expected. As the market digests this and alters expectations we can expect some volatility. However, while the underlying economy remains strong the volatility could present opportunities to take a position in some of the companies with strong fundamentals that have benefitted from a strong rally since October. Based on this we continue to monitor valuations closely.

Asset Allocation

Following the action we took earlier in the year in adjusting our asset allocation we remain patient with our current positioning as we benefit from our thematic decisions in the equity allocation. We continue holding reasonable cash balances to take advantage of any market pull back. The higher for longer rhetoric coming from the Fed has put some pressure on bonds but our view of locking in attractive yields for longer remains in place. Our Structured Notes also continue to perform well and our allocation remains the same.

Market Performance

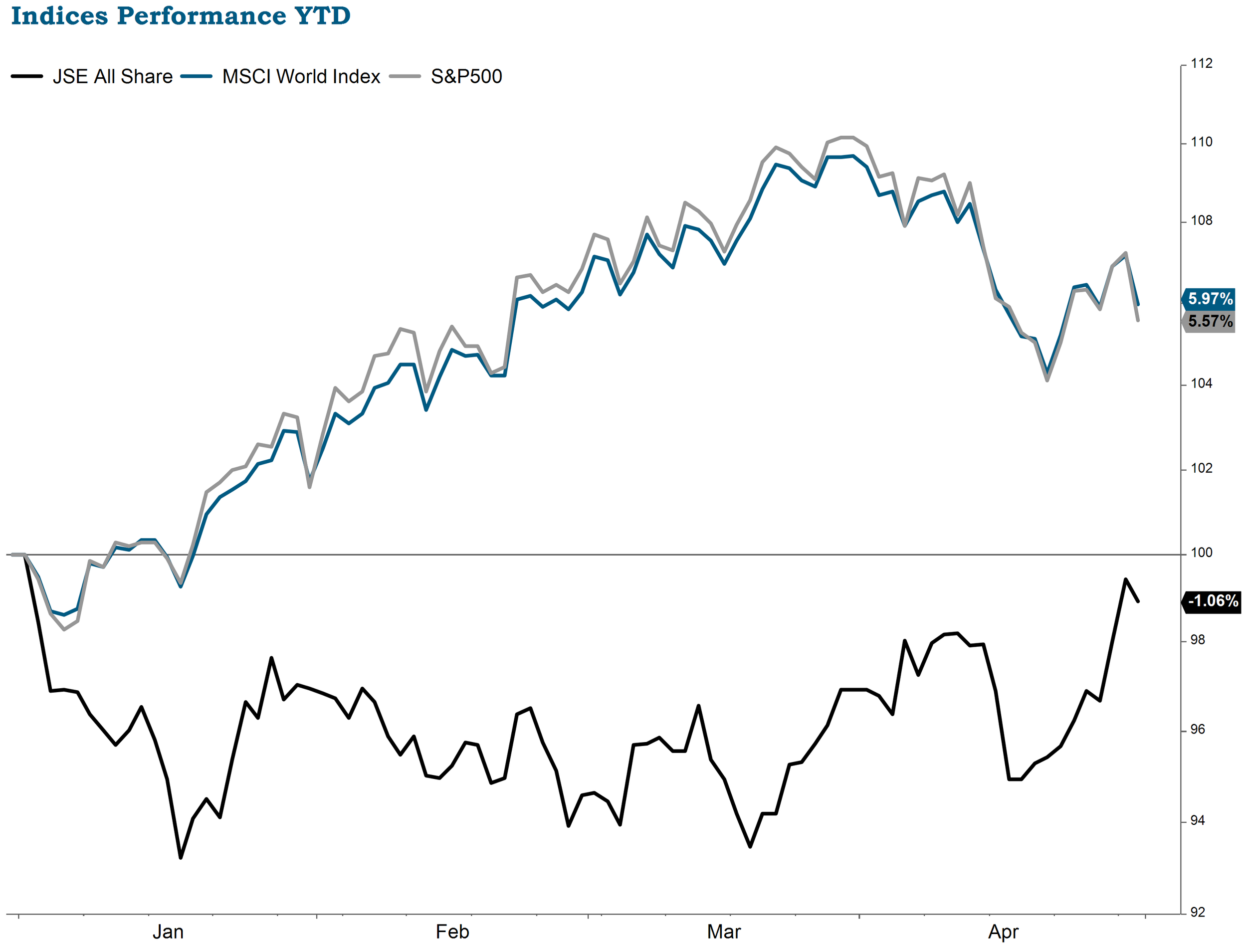

April was a volatile month for markets with the significant moves both up and down on a daily basis. During the month of April, the S&P500 ended down 4.16%. The MSCI World index was down 3.38% for the month and the JSE had a strong finish ending the month up 2.07%. As per chart below the YTD performance of the JSE is -1.06% (in ZAR), while the S&P500 is up 5.57% and the World index is up 5.97% (in USD), respectively.

Bonds

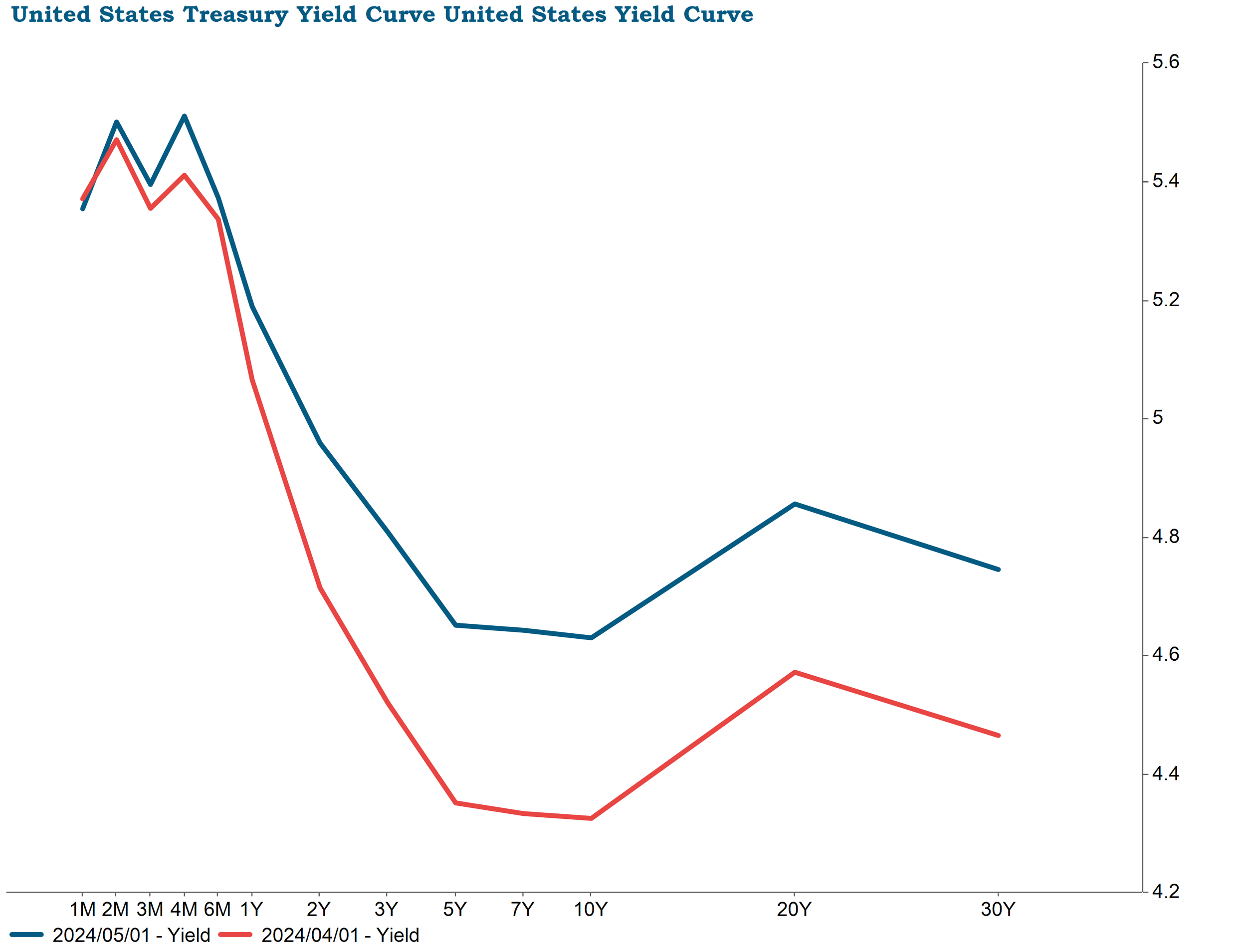

Bonds have seen a lot of volatility in April with the MOVE index (the bond equivalent of the Vix) moving from a YTD low at the end of March of 86.38 to a peak in April of 121.15 reflecting the significant moves seen in the bond market. This can also be seen in the below chart of the US yield curve which shows the yield curve at the end of April versus the end of March. As highlighted by the arrow there as been a significant shift up in the longer end of the curve as markets adjust expectations for fewer rate cuts and the general view that rates will need to stay higher for longer. The yield curve also remains clearly inverted with the shorter end sitting much higher than the longer end. This has historically been a recession indicator but as emphasized previously the macroeconomic data continues to reflect a strong underlying economy.

Equities

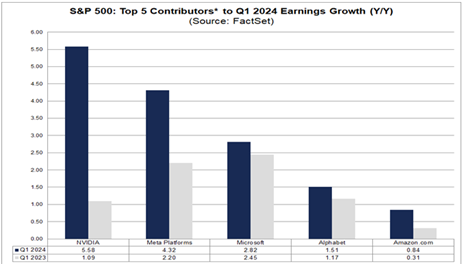

April brought the start of earnings season and to date we have seen 46% of S&P500 companies reporting and 77% of those have reported a positive EPS surprise. So far the blended growth rate for Q1 2024 sits at 3.5% which is slightly ahead of the expectation for 3.4%. To date limited companies have provided guidance and those that have presented a mixed bag. Despite the strong earnings valuations are still fairly rich with the forward PE multiple of the S&P500 sitting at 20.0x which compares to a 5 year average of 19.1x and a 10 year average of 17.8x. There has been a lot of focus on the performance of the Magnificent 7 since October 2023 with a shift coming in 2024 where not all members of this elite group have performed as well. Both Apple and Tesla have been laggards while the other shares have continued their strong performance from 2023. The performance of these stocks is warranted based on their strong earnings as outlined by the chart below. The 5 companies are expected to report growth of 64.3% for the first quarter whereas the remaining companies in the S&P500 would actually see a negative blended growth rate of -6%.

Conclusion

April has been an unpredictable month with significant macroeconomic news flow combined with earnings season resulting in fairly notable single stock moves as well as the market as a whole. As we have seen before it is important to ride out the volatility and avoiding trying to time the market especially when we are seeing such big moves. The action we took earlier in the year to manage asset allocation has provided portfolios with some cash that can be deployed if there is a market correction. Otherwise we are comfortable with the portfolio positioning and the fundamentals of the companies we hold so we will work through the macroeconomic noise and see what the rest of the second quarter has in store. As always please feel free to reach out to the team if you have any questions or would like to unpack some of your portfolio positioning.