September 2025 - Markets show resilience in spite of a continued uncertain landscape

Trade policy remained a headwind, and the looming threat of a US government shutdown further complicated the macro backdrop

Introduction and Macro Overview

September 2025 was a month of pronounced cross-currents in the global investment environment. The U.S. Federal Reserve’s policy trajectory remained the central focus, with markets oscillating between optimism over imminent rate cuts and anxiety about persistent inflation and labor market softness. The Fed’s September meeting delivered a widely anticipated quarter-point rate cut, but policymakers signaled a cautious, data-dependent approach going forward. This stance was echoed in speeches by Fed officials throughout the month, who highlighted both the risks of overtightening and the need to remain vigilant on inflation.

The macro backdrop was further complicated by the looming threat of a U.S. government shutdown, which injected volatility into both equity and fixed income markets. Investors braced for potential disruptions to key economic data releases, including the monthly jobs report, which could have left the Fed and markets “flying blind” on critical indicators. Despite these uncertainties, global equity markets generally held firm, buoyed by resilient consumer spending, robust corporate earnings in select sectors, and renewed optimism in AI and technology stocks.

Trade policy remained a persistent headwind. The Trump administration continued to wield tariffs as a tool of economic and foreign policy, with new and expanded levies affecting sectors from semiconductors and pharmaceuticals to consumer goods and autos. Notably, the administration’s push for a 100% tariff on foreign-made films and new visa fees for skilled workers drew sharp responses from the tech and entertainment industries, highlighting the far-reaching impact of protectionist measures.

Internationally, central banks in Canada, Mexico, and Brazil also moved to cut rates in response to softening economic data, while the European Central Bank and Bank of England maintained a cautious stance.

Portfolio strategy in September reflected a careful balancing act between capturing upside in risk assets and managing downside risks from policy and macro shocks. U.S. equities, particularly in the technology and AI sectors, continued to drive portfolio returns. At the same time, the simultaneous rally in gold—reaching new all-time highs above $3,800/oz—signaled persistent investor caution and demand for safe havens amid geopolitical and policy uncertainty. Fixed income allocations benefited from falling yields as rate cut expectations firmed, but the yield curve remained relatively flat, reflecting uncertainty about the pace and magnitude of further easing.

In South Africa economic activity expanded at a slightly faster pace, with real GDP growth accelerating to 0.8% in the second quarter, supported by stronger performances in agriculture, mining, and manufacturing. Improved weather conditions boosted agricultural output, while mining rebounded after earlier disruptions, particularly in platinum group metals and gold. However, the formal non-agricultural sector continued to shed jobs, with employment declining for the second consecutive quarter, reflecting ongoing structural weaknesses and subdued business confidence. Inflation eased to 3.3% in August, aided by softer food and fuel prices, and the South African Reserve Bank maintained a cautious monetary policy stance. Despite these positive signs, the economy remained under pressure from global trade disruptions and domestic policy uncertainty.

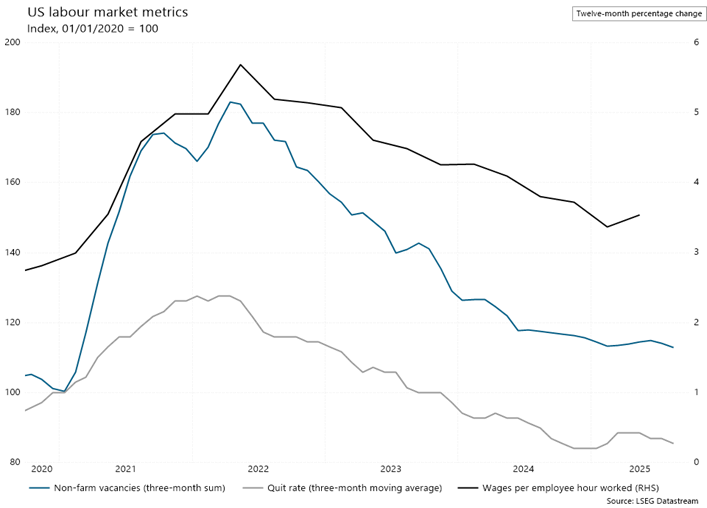

As we enter October the macro environment remains mixed with the US Government Shutdown likely to drive some volatility and the focus will remain on the Fed’s next move as they seek to balance sticky inflation with a weakening labour market. The chart below illustrates the softening in wage growth as well as lack of confidence to quit and find another job. We continue to monitor these events closely and ensure that our clients portfolios are positioned accordingly.

Asset Allocation

Asset allocation remains grounded in a cautiously optimistic outlook as we maintain meaningful exposure to equities in anticipation of further interest rate cuts. However, we have not increased our equity weighting at this stage, given ongoing concerns about tail risks and the potential for renewed volatility. Our allocation to fixed income also remains consistent with previous months, with a continued focus on the shorter end of the yield curve—a positioning that has proven effective as short-term rates have responded favorably to policy shifts. We remain cautious on the longer end of the curve, choosing to keep allocations steady until there is greater clarity on inflation and fiscal dynamics. Structured notes continue to play a key role in portfolios, providing hedged equity exposure and delivering healthy risk-adjusted returns. Overall, portfolios are well positioned to capture potential upside in the final quarter of the year, while remaining acutely aware of the risks and uncertainties that persist in global markets.

Market Performance

September saw a resilient month for markets especially the JSE. The S&P500 was up 3.53% for the month, while the MSCI World was up 3.09%. The JSE was strong again producing 6% for September. As per the below chart the YTD performance for the S&P500 is up 13.7% (in USD) and the MSCI World is up 16.2% (in USD). Locally the JSE currently has a YTD performance of 28.4% (in ZAR).

Fixed Income

Bond markets in September were shaped by the interplay of inflation data, central bank policy, and fiscal dynamics. U.S. Treasury yields fluctuated in response to shifting expectations for Fed rate cuts, with the 10-year yield ending the month near 4.14%. The yield curve remained relatively flat, reflecting uncertainty about the timing and scale of further easing, as well as concerns about fiscal deficits and bond supply. Corporate bond issuance surged, with nearly $70 billion raised in the first week of September alone, as companies sought to lock in funding ahead of potential market volatility.

In September, South Africa’s fixed income market reflected a cautious but stable environment, shaped by both local and global factors. The South African Reserve Bank maintained its policy rate, opting to hold steady after a modest cut in July, as inflation remained well-contained and the rand benefited from a period of relative stability and easing fuel prices. Local bonds responded positively to this backdrop, with yields easing slightly as investors priced in a more accommodative policy outlook. The SA 10 year has seen a steep shift since April per below.

Equities

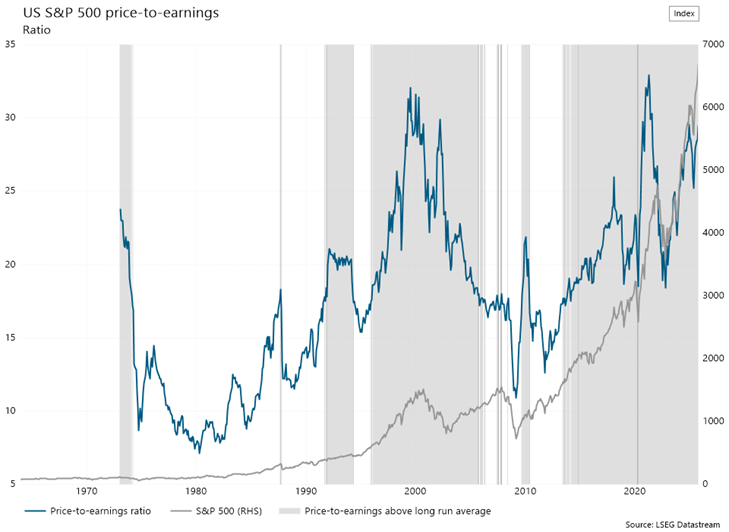

Equity markets demonstrated resilience, with the “Magnificent Seven” tech stocks continuing to drive index performance. However, there were signs of sector rotation, as investors looked for new market leaders and reassessed valuations in the technology space. AI and cloud infrastructure remained key drivers, but the sustainability of the rally was increasingly questioned given the rapid pace of investment and rising debt levels. As outlined by the chart on the next page the S&P500 has been expensive for a number of years now as the debate for a pull back rages on.

Several high-profile companies played a pivotal role in shaping market sentiment throughout September. Nvidia made headlines with its announcement of a $100 billion investment in OpenAI, reinforcing its central position in the ongoing AI revolution and fueling a renewed rally in semiconductor and cloud infrastructure stocks. Alphabet (Google) reached a significant milestone by joining the $3 trillion market cap club and secured a favorable antitrust ruling, allowing it to retain control of key assets such as Chrome and Android, while its AI and advertising businesses continued to deliver strong results.

Oracle also stood out by raising $15 billion in bond sales to fund its cloud infrastructure expansion, a move that highlights the immense capital requirements of the AI arms race; the company further demonstrated its commitment to innovation by appointing new co-CEOs to guide its evolving strategy. Tesla remained in the spotlight with a record-setting $1 trillion pay package for CEO Elon Musk and ongoing efforts to transform into an AI and robotics powerhouse, even as it faced competitive pressures from Chinese automakers and a softening electric vehicle market. In the healthcare sector, Pfizer doubled down on obesity treatments with a $7.3 billion acquisition, underscoring the importance of innovation and M&A activity in high-growth therapeutic areas. Across sectors, trade policy developments—including new tariffs on pharmaceuticals, autos, and consumer goods—prompted companies to reassess global strategies and supply chains. The energy sector experienced mixed fortunes, with oil and gas activity declining in key U.S. states, while mining and materials companies benefited from robust demand and supply disruptions. This dynamic environment reinforced the need for active management and a keen focus on both risks and opportunities across industries.

Conclusion

The Team is reinforcing the importance of a balanced, risk-aware approach to portfolio management. While markets have shown remarkable resilience, the landscape remains fraught with uncertainty—from government shutdown risks and shifting trade policies to central bank independence and sector-specific challenges. The outlook remains cautiously optimistic, but vigilance is warranted as new risks and opportunities continue to emerge.

The investment team remains committed to proactive risk management, ongoing dialogue with clients, and dynamic portfolio adjustments to ensure that allocations are well-positioned for both current conditions and future developments. As always, we encourage clients to reach out for further discussion or to review their portfolios in light of the latest market developments.

Download Investment Environment Article (PDF, 520KB)