Global trade uncertainty causes volatility in markets in April 2025

In the last month single day moves of indices have mirrored previous financial crises, which created an uncertain environment for investors. This has affected SA markets although a VAT increase was avoided and the GNU remains intact which is good news.

Introduction

April has been a month of volatility and uncertainty in markets as the Trump administration has looked to upend global trade. Historic themes of AI, inflation and central bank policy have largely taken a back seat as the market focused on the ‘Liberation Day’ tariff announcement and the various implications. In the last month we have seen single day moves of indices that have mirrored previous financial crises. This uncertain environment is challenging for investors; however, as previously communicated it is important to remain calm and stick to fundamentals as emotional decisions are often wrong.

We have also seen a weakening in the US dollar while the US 10-year treasury yield backed up. Traditionally these assets have been safe havens for investors and in times of panic have generally performed well. This has not been the case in this tariff induced volatility. Investors have rather taken flight to Gold and the Swiss Franc. This brings into question the global sentiment around the US and whether the era of US Exceptionalism is changing. There is no doubt the Trump Administration has lost a degree of trust in global markets as they have taken a broad brush approach to tariffs with a disregard to the global economic fall out. This was further exacerbated by Trump’s social media views that he would like to fire Chairman Powell. This brings the central banks independence into question and naturally unsettles markets.

Although Trump has largely instituted a pause on the Liberation Day tariffs (excluding China) and has advised he is not looking to fire Chairman Powell, the reputational damage is more difficult to unwind. Most market participants are finding it impossible to take a view with the constant changing policies and unclear outlook from the administration. In addition, the administration has been poor at communicating and instead of easing information into markets they tend to drop huge market moving announcements. It is also unclear who really has Trump’s ear at the moment. There is no doubt the most rational and well received from a markets perspective is Scott Bessent but there are other advisers such as Howard Lutnick who are also moving markets whenever they speak. There are lots of different angles at the moment but stepping back we need to assess this new macro environment we are facing and as we have a clearer view on the various permutations we will position portfolios accordingly.

Locally the markets have also been impacted by the larger macro environment although have held up a bit better. The VAT increase has also been avoided so the Treasury now needs to find funding for that shortall. The good news is that the chance of the GNU holding together is higher. There is no doubt we are living in interesting times both locally and abroad.

Macro Environment

The Liberation Day announcement will be an event that we look back on in history as a pivotal point in the global trading environment. Out of all the forecasts we saw prior to the announcement even the most bearish scenarios did not come close to what was announced. It appeared almost no countries were spared and that Trump was looking to eradicate the trade deficit through a tariff. The administration has only focused on goods trade and largely ignored services which the US has a significant impact globally. In addition to deciding on tariffs they took into account trade barriers such as VAT as well as supposed currency market manipulation. Many of these factors are very vague and so it will be difficult for countries to negotiate on a number of elements. The rhetoric coming out of the White House is that the negotiations with a number of big economies such as Japan are going well. However, we are yet to get any hard information as to what has been agreed and this adds to the market uncertainty. Should the tariffs announced on Liberation Day go ahead the chance of a number of regions tipping into recession would be high and a number of strategists have increased their likelihood of a US recession. The market is hopeful that sense will prevail and a better outcome for the global economy will be negotiated. We are all waiting to see how the next few months play out. Regardless of the outcome tariffs will be a reality and this has a knock on effect to a number of areas. Exporters may need to drop their price, currencies could devalue, importers could take a margin hit or the increases could all land at the consumer door. As per the below chart it appears these could start taking a toll on the US consumer.

Asset Allocation

Although we are monitoring our portfolios and asset allocation very closely in this environment we are proactively keeping our current allocation unchanged. As we have mentioned we took some action at the end of 2024 which has helped protect portfolios. We do not feel there is enough clarity in the current environment to make changes and so we remain unchanged both locally and offshore. We are comfortable with the current risk reward profile for the portfolios taking into account the investment environment.

Market Performance

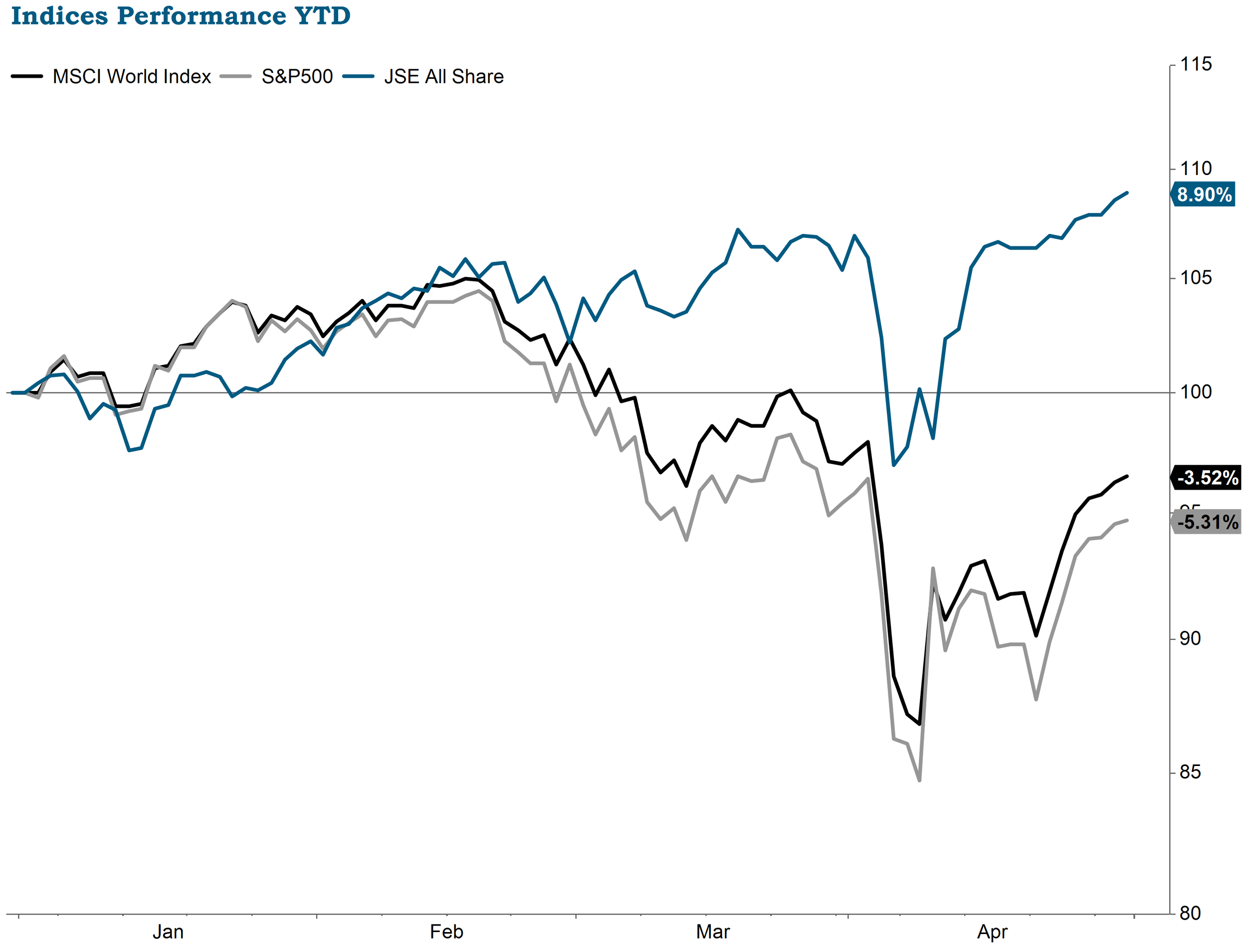

Within the volatility the markets saw a strong recovery at the end of the month to end largely flat. The S&P500 was down 0.76% for the month, while the MSCI World was down 0.52%. The JSE was an outlier producing a positive 3.32% for April. As per the below chart the YTD performance for the S&P500 is down 5.31% (in USD) and the MSCI World is down 3.52% (in USD). Locally the JSE currently has a YTD performance of 8.9% (in ZAR).

Fixed Income

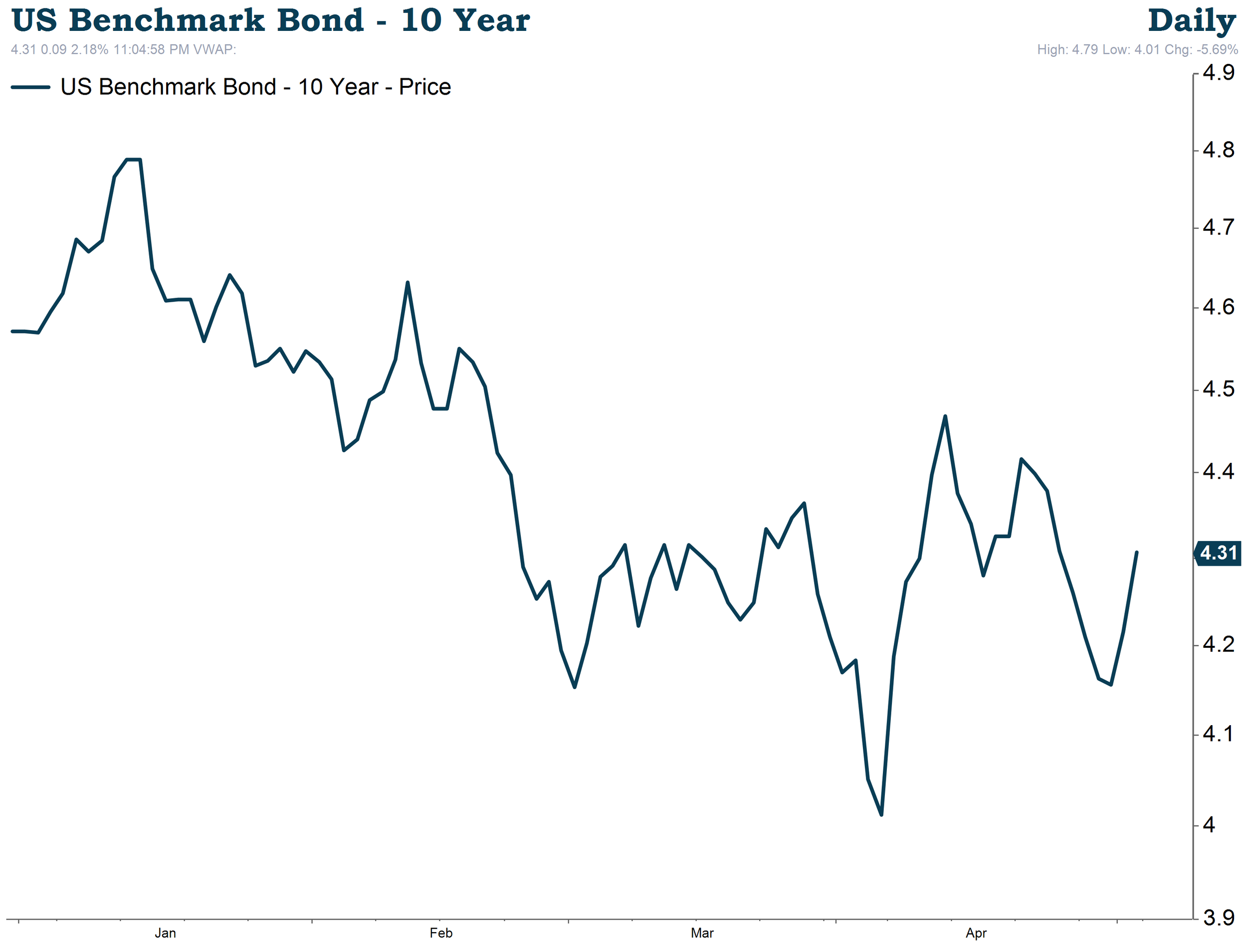

The bond market has been a key focus in the last month and many are of the view it was the backup in the US 10 year yield per below that resulted in Trump pausing tariffs for all countries except China. The 10 year yield has a knock on effect to other rates such as mortgages and is also used as the risk free rate in financial markets so the bond market was sending a clear message to the Trump administration that they were not happy with the current policies. There were also rumours some foreign debt holders were selling into the market to put upward pressure on yields.

Equities

While an uncertain macroenvironment became a key theme in April we also had the kick off on earnings season. Generally Q1 results reported to date have been good although analysts have revised down from December forecasts. The big theme in earnings has been a focus on guidance with a number of companies pulling guidance due to the uncertain environment while others have maintained guidance with the caveat that there is a lot of uncertainty so their ranges might be a bit wider. This is not surprising in the current environment as most of the corporate leaders are running a variety of different scenarios to try position for the various tariffs. So far, nearly 77% of results reported have surpassed consensus expectations and earnings are surprising on the upside by nearly 6.5%. This helps support the strength of US companies albeit with a lot of uncertainty to deal with. An interesting extract from the Federal Reserve’s Beige Book is outlined below where the uncertainty around tariffs is the dominant discussion point amongst businesses.

Conclusion

The investment environment has changed significantly in the last month and this volatility can be unsettling. We have, however, seen this before and navigated through the uncertainties in the past. We are monitoring events and company results very closely and as a team having frequent debates to ensure we are cutting through the noise and sticking to the important fundamentals that have a material impact on long term investing. We want to emphasise to all our clients we are available and are happy to have a meeting or jump on a call to discuss the current environment and portfolio positioning.

Download Investment Environment Article (PDF, 484KB)