A Rebound in Global Markets in May 2025

Volatility eased compared to April but uncertainty persisted as the U.S. economic sentiment was shaped by shifting trade policies, fiscal concerns, and inflation pressures.

Introduction

Global markets rebounded strongly in May, continuing their recovery from April’s sell-off. While themes like AI, inflation, and central bank policy remained relevant, investor focus shifted to trade negotiations and their broader implications. Volatility eased compared to April, but uncertainty persisted.

In the U.S., economic sentiment was shaped by shifting trade policies, fiscal concerns, and inflation pressures. A temporary 90-day reduction in tariffs on Chinese goods offered some relief, but overall tariff levels remained high. This, along with a modest improvement in consumer and business confidence, was overshadowed by Moody’s downgrade of the U.S. credit rating due to rising deficits. The Federal Reserve held rates steady, balancing inflation risks with signs of slowing growth. Labor markets remained stable, though forward indicators pointed to softening demand.

President Trump’s threats of 50% tariffs on EU goods and a 25% levy on Apple iPhones rattled markets, triggering a sell-off and boosting demand for safe-haven assets like gold. Long-term Treasury yields rose amid concerns over a proposed tax bill that could add $3.8 trillion to the national debt. All of these variables added to the uncertainty in markets and despite positive momentum there is general unease amongst market participants.

Globally, investor sentiment was also influenced by upcoming economic data from Latin America and earnings reports from major U.S. firms like Nvidia and Macy’s. These were closely watched for insights into consumer behavior and the impact of tariffs on supply chains.

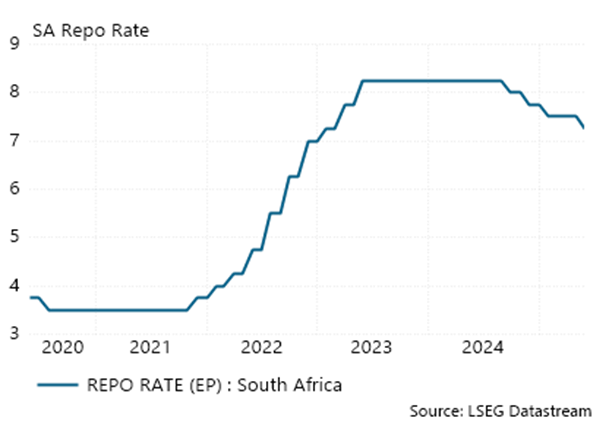

The South African Reserve Bank’s Monetary Policy Committee (MPC) cut the repo rate by 25 basis points in May, offering some relief to households and businesses amid a challenging economic environment. Alongside the rate cut, there was renewed discussion about shifting the inflation target from the current 3%–6% range to a fixed 3% target. While significant groundwork has been laid, the proposal has yet to be finalized. The South African rand showed resilience against the U.S. dollar during the month, supported by both domestic policy easing and global factors. A softer dollar—driven by trade tensions and a weaker U.S. economic outlook—boosted emerging market sentiment, helping the rand hold firm despite ongoing global uncertainty. Overall, the currency’s performance reflected a combination of local monetary policy support and improved investor risk appetite.

Overall, markets remained cautious, navigating a landscape of policy-driven volatility and economic fragility.

Macro Environment

Tariff uncertainty continues to dominate market sentiment, with investors coining the acronym “TACO” (Trump Always Chickens Out) to describe the pattern of bold trade threats followed by quick reversals. This dynamic was on full display when a proposed 50% tariff on EU goods, initially set to take effect on June 1, was swiftly postponed to July 9 to allow for further negotiations. The announcement triggered a sharp market sell-off, followed by an equally rapid rebound once the delay was confirmed. While such volatility can create opportunities for short-term traders, it poses challenges for long-term investors, who may find the constant swings unsettling. In this environment, we’re adopting a more cautious approach to portfolio management, focusing on stability and long-term fundamentals amid the noise.

At its May 2025 meeting, the South African Reserve Bank’s MPC cut the repo rate by 25 basis points to 7.25%, aiming to support the economy amid subdued inflation and slowing growth. Five of six members backed the move, with one favoring a deeper cut. Inflation remained below the 3–6% target range, helped by lower fuel prices and the scrapping of a planned VAT hike. Core inflation held steady at 3%. Weak performance in mining and manufacturing, along with rising unemployment, led to a downward revision of 2025 GDP growth to 1.2%. Despite global volatility, the rand showed signs of recovery, and the rate cut was intended to ease pressure on consumers and stimulate domestic activity.

Asset Allocation

In a strong market like we have seen in May it is easy to jump on the bandwagon and upweight equity allocation but after much debate the Team does not have enough conviction on the current outlook to take on more risk. We are comfortable with our current allocation and underlying holdings and believe portfolios are well positioned from a risk reward perspective using equity, fixed income and structured notes alongside strategic cash. We are looking for opportunities both locally and offshore but also seeking to manage risk in an uncertain environment.

Market Performance

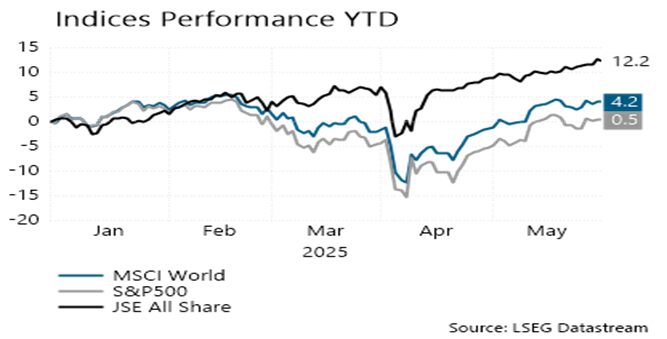

May saw a strong recovery from a volatile period. The S&P500 was up 6.15% for the month, while the MSCI World was up 5.69%. The JSE was also positive producing 3% for May. As per the below chart the YTD performance for the S&P500 is up 0.5% (in USD) and the MSCI World is up 4.2% (in USD). Locally the JSE currently has a YTD performance of 12.2% (in ZAR).

Fixed Income

The long end of the US yield curve has been rising with the 30 year breaking through 5%. This reflects investors growing concerns around the US fiscal outlook as debt levels continue to rise and the “Big Beautiful Bill” is likely to result in larger budget deficits. As a result investors demand a higher return to hold long term government debt. This was further exacerbated by Moody’s downgrading the US credit rating and we have seen weaker demand at recent long term bond auctions. This is an area that the market is monitoring. Below is the 30 year yield outlining the steep move up in yields.

Equities

U.S. equities delivered a strong performance in May, even as uncertainty remained elevated. Markets were largely driven by macro developments, particularly around trade policy and tariffs. The tail end of earnings season also played a key role, with Nvidia—now the second-largest U.S. company—reporting results that beat expectations once again. Despite ongoing concerns about export restrictions to China, Nvidia’s performance remained robust, though its forward guidance came in slightly below market forecasts due to the loss of an estimated $8 billion in Chinese revenue.

Overall, earnings season exceeded expectations, but many companies flagged a highly uncertain outlook for the rest of the year, citing the unpredictable impact of tariffs. This uncertainty has made long-term planning difficult for executives and contributed to heightened market volatility. Daily price swings, especially in high-profile names like Nvidia, have resembled the erratic behavior of much smaller stocks, reflecting the market’s sensitivity to shifting headlines. Amid this noise, our focus remains on fundamentals—investing in companies with strong core businesses aligned with long-term growth themes we believe will deliver outsized returns.

Conclusion

Markets rebounded strongly in May, offering a welcome relief following the sharp sell-off earlier in the year. However, the broader macroeconomic landscape remains clouded by uncertainty, with ongoing concerns around tariffs, fiscal deficits, inflation, and geopolitical tensions continuing to dominate the narrative. We recognize that such volatility can be unsettling for clients, as it often leads to significant swings in asset prices. In response, our team is dedicating considerable time to in-depth analysis, rigorous debate, and careful portfolio reviews. Our goal is to cut through the noise and ensure our positioning reflects a thoughtful balance of risk and reward. As always, we are available to discuss individual portfolios, the evolving macro environment, and how we are navigating these complex conditions.