Constant changes in January 2026

Rolling waves of opportunity and uncertainty, political messaging and commodity dynamics replaced any straight path toward clarity.

Introduction and Macro Overview

January unfolded as a month defined by constant changes across markets, with investors digesting an unusually dense mix of macro data, geopolitical storylines and earnings driven signals. Instead of a straight path toward clarity, the opening weeks of 2026 offered rolling waves of opportunity and uncertainty, as global markets reacted to every marginal shift in rates expectations, political messaging and commodity dynamics. What stood out most was how frequently the market narrative rotated: from labour market resilience to inflation moderation; from geopolitical flare ups to temporary easing of tensions; from volatility in technology leaders to broadening participation across sectors. Markets behaved as though they were continually recalibrating—never fully embracing risk, but also reluctant to abandon the constructive undertone established late last year.

A central theme across January was the push and pull around the Federal Reserve’s policy path. Incoming data painted a picture of an economy that is cooling at the margins but still fundamentally resilient. Job growth moderated, yet unemployment remained contained; wage signals were mixed, but not alarmingly so; and inflation progress, while ongoing, began to show the possibility of levelling off. This created an environment in which the market frequently reassessed whether the Fed would cut early, cut later, or perhaps not cut as much as previously anticipated. As a result, yields moved within relatively tight ranges but exhibited sharp intraday swings as each data release reshaped expectations. Many investors came to accept that the Fed is firmly data dependent, not eager to pre commit to easing until the disinflation trend becomes more entrenched, and mindful that premature optimism could undermine progress already made.

Geopolitical developments layered an additional dimension of uncertainty that fed through to commodities, currencies and risk appetite. The Venezuelan leadership crisis and evolving supply expectations, renewed tensions around Iran, and the lingering effects of broad tariff threats contributed to an environment in which oil prices swung meaningfully. At various points, markets had to balance concerns that supply disruptions could tighten balances against periods when diplomatic signals suggested the risk premium might ease. Gold and silver reiterated their importance as safe haven assets, repeatedly attracting flows whenever geopolitical temperature rose or doubts around U.S. policy coherence surfaced. Importantly, these dynamics unfolded not in isolation but as part of a broader recalibration of global trade relationships, with several regions actively exploring diversification to limit vulnerability to U.S. policy swings.

Regional markets saw a dispersion in January. The U.S. maintained a leadership position driven by resilient earnings and the depth of its AI ecosystem. Japan benefitted from strong corporate profitability and currency conditions that improved exporter competitiveness, though yen volatility added tactical complexity. Europe was sensitive to policy rhetoric, energy dynamics and mixed industrial conditions, which created a more stop start pattern for returns. Emerging markets were split: commodity linked economies found tailwinds from firm metals prices and persistent demand for critical materials, while others faced pressure from political shifts, labour market softness, or funding conditions that grew more challenging as global yields fluctuated.

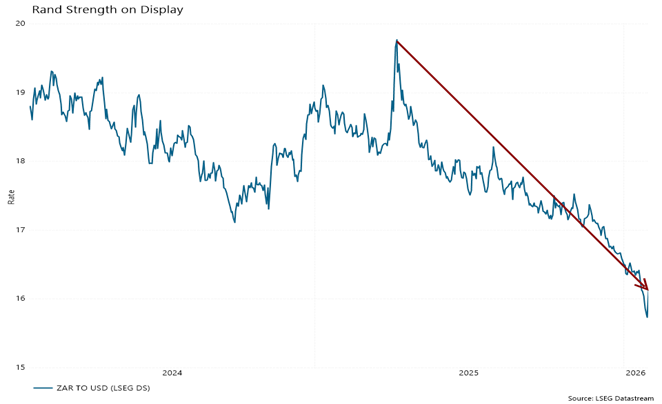

The rand’s recent strength reflects a combination of powerful tailwinds: South Africa is benefiting from exceptionally strong terms‑of‑trade gains as gold and PGM prices surge while oil prices fall, alongside renewed foreign appetite for local bonds and a weaker US dollar driven by Fed cuts and fading US exceptionalism. Domestic fundamentals have also turned more supportive, with progress on fiscal consolidation, South Africa’s exit from the FATF grey list and an S&P credit upgrade all helping sentiment. However, risks remain: a rebound in the US dollar, global risk‑asset sell‑offs—particularly if an AI or tech‑led correction materialises—and any domestic growth disappointments or political instability could all put renewed pressure on the currency.

Asset Allocation

We maintained a cautiously constructive posture throughout January, focusing on selective opportunities while respecting the elevated sensitivity of markets to macro and geopolitical uncertainty. Equity exposure remained concentrated in companies with strong balance sheets, durable cash flows and pricing power, particularly those positioned to benefit from sustained AI infrastructure investment and real‑economy capital expenditure. We reduced exposure to areas where valuations extended ahead of earnings credibility and redeployed into parts of the market where fundamentals and sentiment were beginning to align more positively. In fixed income, we balanced high‑quality duration with selective credit exposure, favouring issuers offering compensation for late‑cycle risk without compromising balance‑sheet resilience. We continue to use Structured Notes for risk diversification in portfolios.

Market Performance

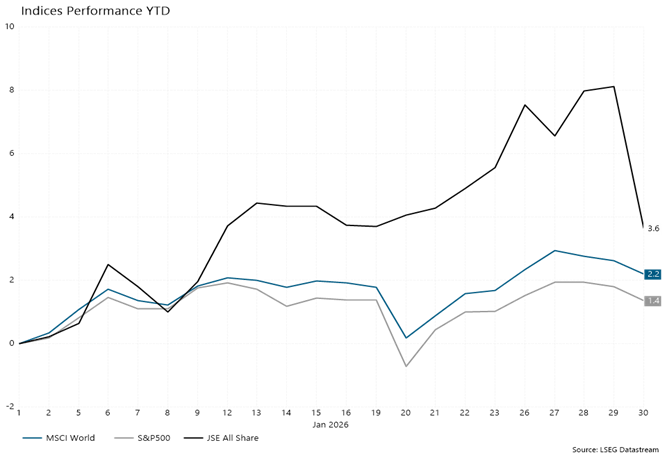

January saw markets start the year on the front foot despite all the volatility. As per the below chart the year to date performance for the S&P500 is up 1.4% (in USD) and the MSCI World is up 2.2% (in USD). Locally the JSE currently has a YTD performance of 3.6% (in ZAR).

Fixed Income

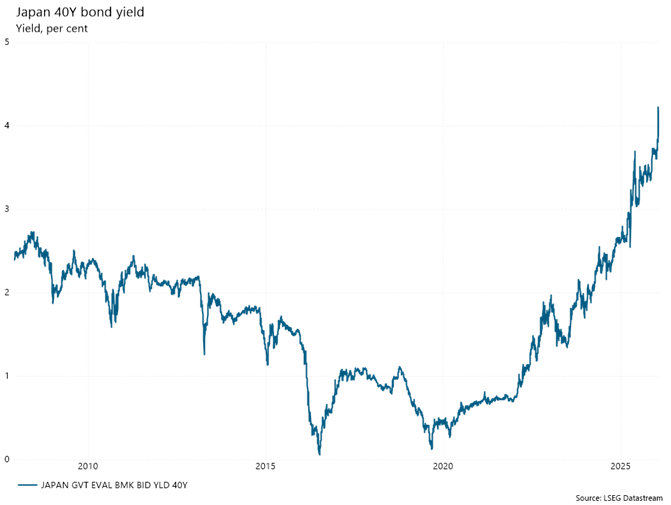

Rates markets spent January responding to each incremental piece of economic data, resulting in a steady but choppy pattern across the curve. Softer job creation contrasted with firmer wage growth, and the market reassessed the timing and magnitude of possible Fed cuts. This produced a holding pattern in yields, with volatility contained but persistent. Credit conditions remained constructive, supported by strong corporate fundamentals, healthy liquidity, and a generally stable earnings backdrop, though idiosyncratic risks remained elevated in lower‑quality segments. As outlined by the chart on the next page Japan saw the long end of the curve back out as stimulus is causing concern in the bond market.

Our positioning remained balanced. Focus on core duration played its role as a portfolio stabiliser, while high‑quality credit provided incremental yield without undue risk. We maintain a cautious approach for Fixed Income in the current environment.

Equities

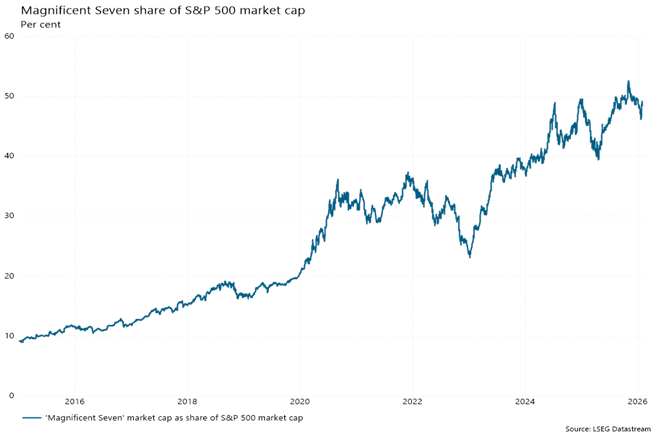

Equity markets provided a nuanced mix of challenges and opportunities in January. Technology’s leadership faltered early in the month as investors questioned the near‑term payoffs of heavy AI spending, resulting in bouts of de‑risking across mega‑caps. This resulted in a slight dip in the Magnificent seven; however, as illustrated on the next page they remain the dominant driver of the S&P500. This dip created space for healthier market breadth. Companies linked to AI infrastructure—from semiconductor suppliers to memory producers to power‑reliability equipment makers—benefitted from strong demand projections and improving order trends. Financials received support from stronger‑than‑expected trading revenues and signs of a pipeline recovery in investment banking, while selected consumer, industrial and healthcare names demonstrated resilience as earnings surprised positively.

The key to navigating equities this month was selectivity. Businesses with dependable cash‑flow profiles, competitive advantages and exposure to multi‑year trends continued to outperform. Overall, equity markets rewarded quality, earnings visibility and alignment with structural growth themes.

Conclusion

January reinforced the core principles guiding our 2026 investment approach. Quality, liquidity and discipline remain central to navigating an environment where macro and geopolitical noise can shift sentiment rapidly. We continue to lean into companies with consistent earnings power, resilient balance sheets and exposure to durable structural themes such as AI infrastructure, energy transition and healthcare. At the same time, we remain ready to deploy capital into opportunities created by short‑term dislocations, while maintaining appropriate hedges and diversification to manage downside risks. The year ahead will undoubtedly bring further volatility, but it also presents attractive opportunities for patient, selective investors focused on long‑term compounding.

Download Investment Environment Article (PDF, 549KB)