A turbulent year closes out in December 2025

The Federal Reserve dropped rates by 25bp and commodities and precious metals rallied, while equities consolidated after a long run.

Introduction & Macro Overview

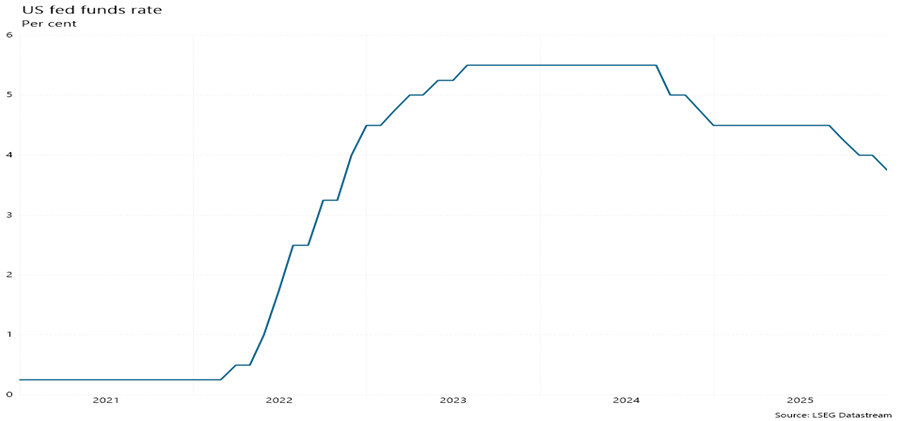

December 2025 closed out a turbulent year in global markets, one defined by a constant tension between hopes for monetary easing and a complex backdrop of geopolitical strain, fiscal uncertainty, and rapidly shifting global supply dynamics. Investors entered the final month still digesting the cumulative impact of multiple macro shocks—from oscillating US data releases to renewed conflicts affecting key commodity corridors—and this produced a market environment characterised by sharp rotations and fleeting risk appetite. Yet despite the noise, the overarching narrative remained one of cautious optimism: the Federal Reserve delivered a third consecutive 25bp rate cut, reinforcing a trend toward policy normalization even as pockets of dissent within the FOMC signalled discomfort with the rapid shift in direction. This internal division revived longstanding debates around the durability of central bank independence, especially with a politically charged 2026 ahead and market participants increasingly attuned to the tone, cohesion, and intent behind every policy statement.

Monetary uncertainty intersected with a set of powerful cross-currents in global commodities. Precious metals experienced an exceptional rally, with gold, silver, and platinum all breaking new records as investors sought a hedge against both macro volatility and a steady drumbeat of geopolitical flashpoints. Oil markets meanwhile remained reactive to supply disruptions and shipping risks across critical trade routes, as intermittent shutdowns, regulatory actions, and weather-related bottlenecks tightened balances unexpectedly. The combination of safe-haven demand, supply‑side constraints, and pervasive uncertainty contributed to a notable divergence between “risk‑off” commodity behaviour and the more measured optimism in equity markets—highlighting a year-end environment where capital flows were driven as much by hedging and positioning dynamics as by fundamentals.

Equities, for their part, managed a quiet but persistent grind higher through thin holiday trading conditions. The rally broadened modestly beyond megacap technology, with cyclicals and defensives each finding pockets of support depending on the day’s prevailing narrative—whether rate‑cut enthusiasm, geopolitical anxiety, or commodity‑linked rotation. Liquidity was patchy, amplifying otherwise ordinary flows, yet corporate earnings resilience and improving investor sentiment toward a 2026 soft‑landing scenario helped anchor markets into the final trading sessions of the year.

Taken together, December encapsulated the defining features of 2025: resilience amid uncertainty, narrow escapes from broader macro shocks, and a market that remained willing to look ahead—cautiously but constructively—as the new year approached.

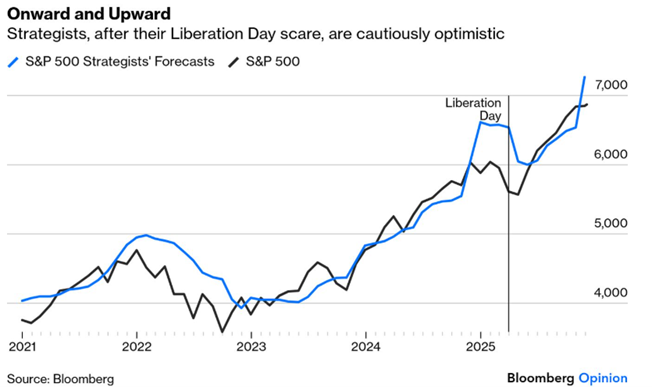

Looking forward to 2026 we are excited for what the year has in store for markets. Strategists hold a bullish view for the S&P500 with the average year end target seeing a 9% gain from current levels. While we don’t place reliance on strategists targets from a portfolio management perspective it does give us good insights into the sentiment in market. While there are some strong tailwinds from the likes of AI and anticipated rate cuts we still have a number of risks that will need to be considered. In addition, we are exploring some new themes to potentially introduce into portfolios once through our investment process. We believe the focus for this year should be to capture potential upside without creating unnecessary risk in the portfolios as we come off the back of three years of strong performance. We also think there are some positive green shoots in South Africa which is a nice change although it will take a while for the results to yield we stay alive to opportunities.

Overall, 2026 will be another year of big headlines and diverging views. We will continue to manage portfolios following our centralised process and ensure continuous engagement with clients. There is no doubt there will be volatile times to navigate but we remain focused on creating long term capital growth and benefitting from the power of compounding. Let us see what 2026 has in store for us.

Asset Allocation

We maintained a cautiously constructive posture. Offshore equity exposure stayed selective with an emphasis on quality balance sheets and cash flow resilience. Hedges were kept in place given thin year-end liquidity and event risk. Locally, we preserved our overweight to South African government bonds on attractive real yields and a supportive inflation backdrop, while equity risk was sized to reflect strong JSE year-to-date gains alongside heightened global policy noise.

Market Performance

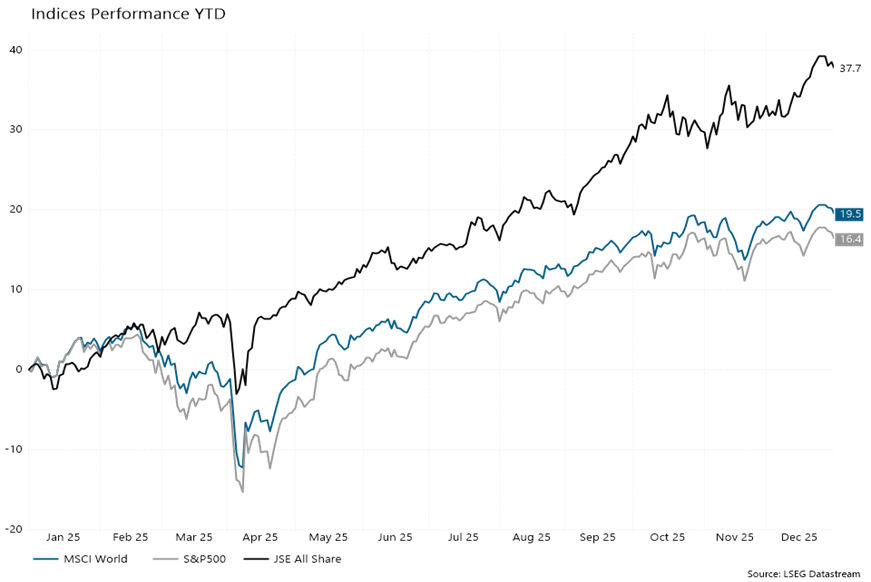

December saw markets finish the year strong despite some volatility early in the month and thin trading. The S&P500 was down 0.05% for the month, while the MSCI World was up 0.73%. The JSE was up again producing 4.39% for December. As per the below chart the year performance for the S&P500 is up 16.4% (in USD) and the MSCI World is up 19.5% (in USD). Locally the JSE currently has a YTD performance of 37.7% (in ZAR).

Fixed Income

The Fed’s third straight cut (as per chart below) supported a lower-rate narrative, but growing internal dissent and leadership speculation left forward guidance murky. US 10-year yields hovered near the 4%–4.2% range into month-end. Japan’s long-end saw improved demand at auctions as higher yields drew buyers back, while the BoJ telegraphed that more hikes are likely over time. In South Africa, a stable inflation trajectory continued to underpin the appeal of local bonds.

Equities

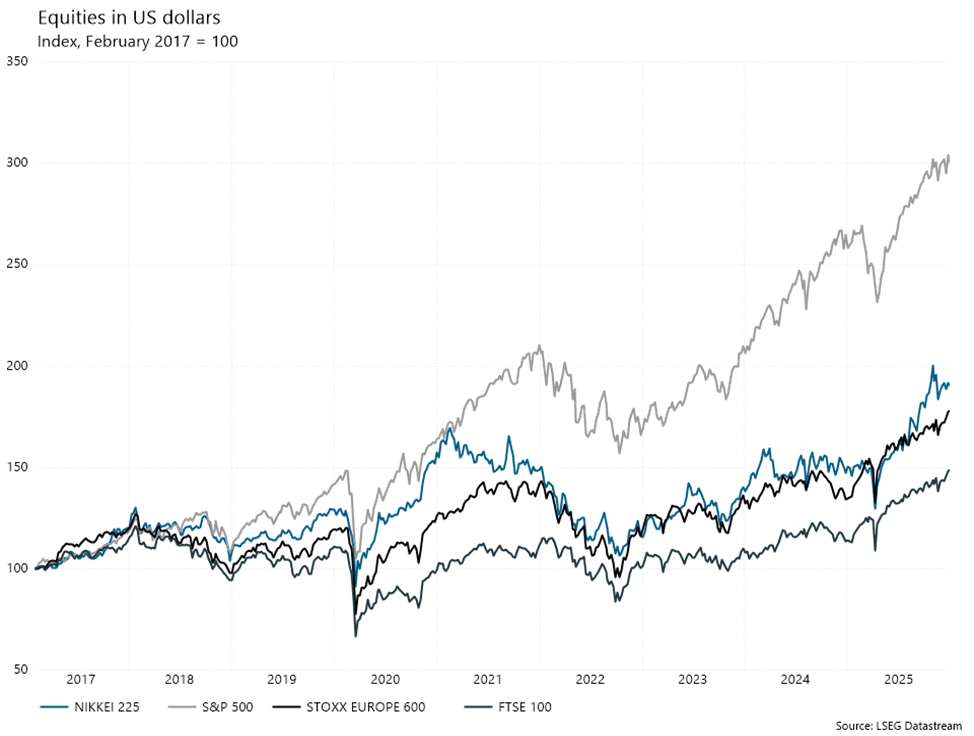

US equities consolidated after a strong run, with breadth improving as cyclicals participated. AI remained a dominant theme, though leadership rotated and profit-taking set in across some winners. Europe’s defense and industrial complex faced input constraints tied to rare earths, while selected healthcare names remained buoyant on obesity-pill approvals. Emerging markets saw differentiated performance, with haven flows into higher-quality EM local debt and select equities. The S&P500 has been the star performer over recent years per below and is expected to achieve similar going into 2026.

Conclusion

December reinforced our 2026 playbook: stay hedged, lean into quality, and be ready for fast shifts in rate, policy, and liquidity regimes. We remain defensively tilted but opportunistic, with dry powder to add on dislocations and portfolio protections sized to reflect event risk.

We are excited to reconnect with our clients and are ready to handle whatever 2026 has in store for us. We hope everybody enjoys the remainder of their holidays and travels back safely!